The gift recipient's carryover basis can be increased where the donor has paid a federal gift tax on the transfer The amount of the gift tax that is attributable to the appreciation in value of the asset as of the date of the gift can be added by the recipient to his carryover basis For instance, if the donor's cost basis in an asset isWhether you're new to the language or are fairly proficient, you can learn what to say when you're giving or receiving a gift in just about any situation Formal and Informal Situations In much of the Englishspeaking world, it is customary to use the right tone when giving and receiving giftsIf you entered gifts on Part 2, or if you and your spouse elected gift splitting and your spouse made gifts subject to the GST tax that you are required to show on your Form 709, complete Schedule D, and enter on line 10 the total from Schedule D, Part 3, column G Otherwise, enter zero on line 10

Electronic Gifts For Teen Boys They Will Go Crazy For These

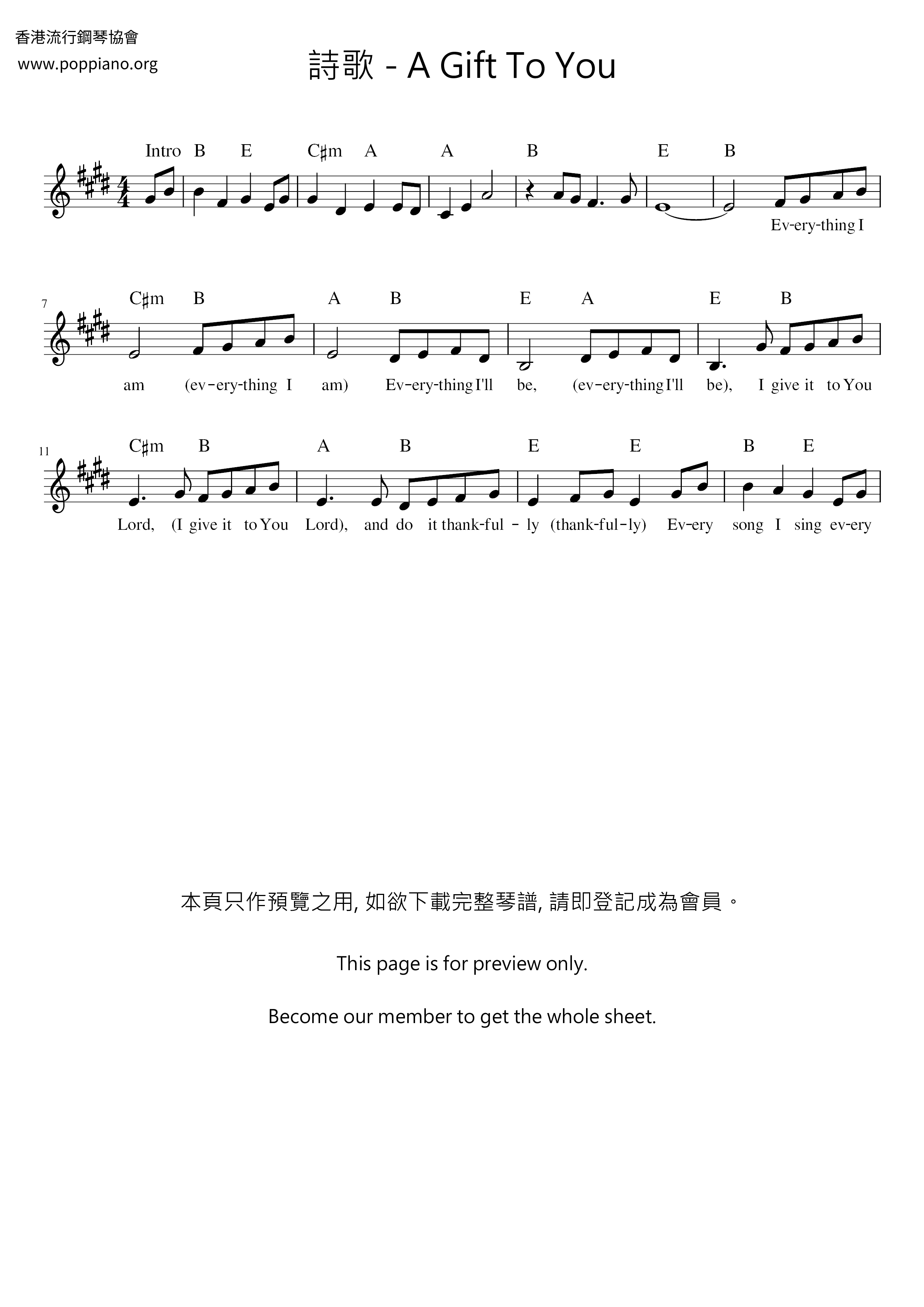

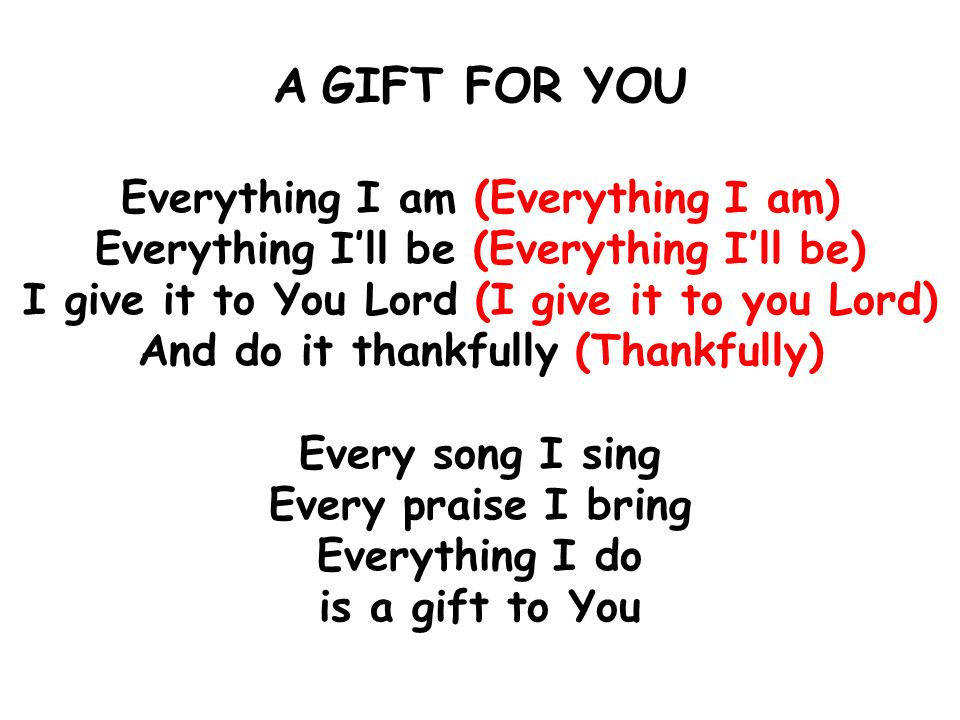

A gift to you lyrics

A gift to you lyrics-A gift to youFirst, you should realize You ask which sentence is correct, but you have not provided any sentence (Neither "nice gift to me" nor "nice gift for me" is complete sentence) That's part of the problem, because which preposition is better to use might well depend on the verb in the sentence For example, I might say My wife bought a nice gift

What To Do When A Christmas Present Won T Arrive On Time

A gift to youThe greatest gift you can give someone is your time because when you are giving someone your time, You are giving them a portion of your life that you will never get back Anonymous 55 Each day is a gift don't send it back unopened Anonymous 56 God gave us the gift of life;You should give a gift that reflects how long you've known each other and how close you are If you give too expensive of a gift to a new friend, they'll be put off by it By the same note, a generic gift for an old friend may make your friend feel as if you weren't as close as they thought you were

People often wonder whether they need to bring a gift to a gender reveal party And the answer is, yes — if you want to Typically, in this case, the gift you take is for the mom and/or dad to be, not the baby because gifts for the baby are given at the baby shower If the baby shower and gender reveal party are combined, you should considerDo You Take a Gift to a Gender Reveal Party?Return a Gift The Returns Center allows gift recipients to return items marked as a gift at the time of purchase The type of refund or credit you receive depends on how the gift was purchased and how it's returned Gift recipients won't be eligible for exchanges or instant refunds

A Gift To You Chords by Misc Praise Songs Learn to play guitar by chord / tabs using chord diagrams, transpose the key, watch video lessons and much moreA hostess gift is what you bring to someone's house when they are hosting you for dinner or for a gettogether A classic hostess gift is a nice bottle of wine, but if your hosts do not drink or if you are looking for a more unique gift, you may go homemadeThank you for being so great 85 Thank you for this gift Please always remember how much I cherish you and the things you do for me You are so thoughtful and caring, and I thank you 86 I cannot express to you just how special I felt when I received your marvelous gift

Can I Send Someone A Gift Directly Redbubble

41 Best Thank You Messages For An Unexpected Gift Thebrandboy Com

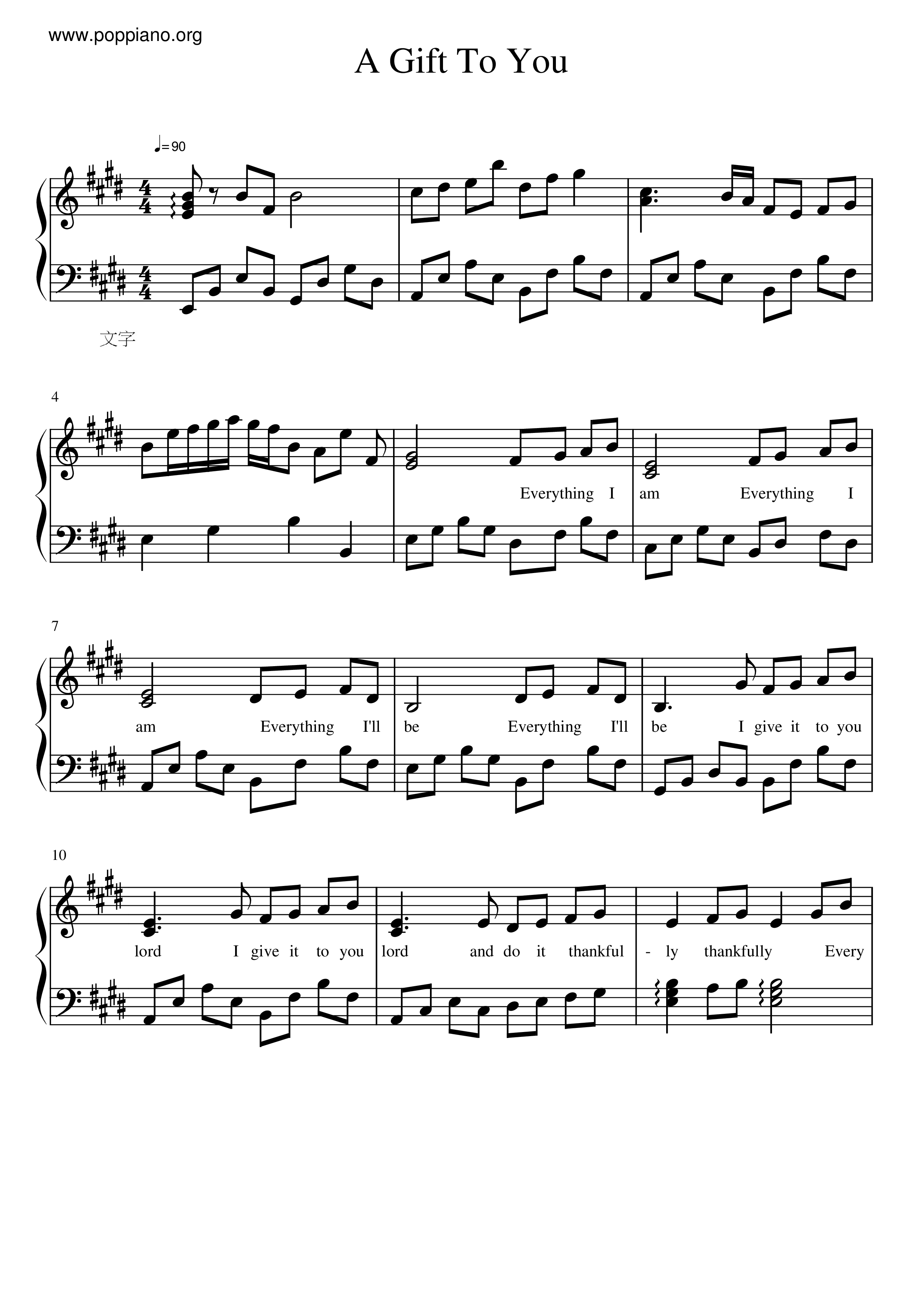

A Gift To You From Kids In Worship A child's song of personal dedication (255) Everything I am Everything I'll be I give it to You, Lord And do it thankfully Every song I sing Every praise I bring Everything I do is a gift to You Everything I have All You've given to me I give it to You, Lord And do it thankfully Every song I sing EveryGift In Trust An indirect bequest of assets to a beneficiary by means of a special legal and fiduciary arrangement The purpose of a gift in trust is to avoid taxes on gifts that exceed theIn 19, you can give up to $15,000 to an unlimited number of individuals each year without paying a gift tax or even reporting the gifts If you give over that amount to any individual, however, you must report the gift on your tax return, but you don't have to pay taxes until you give away more than the current lifetime limit of $114 million

Your Love Is A Gift You Are A Gift So This Is Exactly What I Have For You Me And My Love Happy Free Cards

Your Talent Is God S Gift To You Pictures Photos And Images For Facebook Tumblr Pinterest And Twitter

For example, you may not be able to get out of giving a close relative a gift, even when they do not say "thank you" Rather than get them a lavish gift, you may go for a less expensive gift so you spend less money on them and potentially feel less upset about not receiving a thank you from themThe halls are decked, the gifts unwrapped, and the festivities celebrated—albeit in a slightly different way than usual this yearNow, you may have found yourself with a few gifts from wellmeaning relatives and inlaws that you appreciate, but just don't loveYes, it's the thought that counts, and getting a gift from someone is always special and heartwarming, but what do you do withThe halls are decked, the gifts unwrapped, and the festivities celebrated—albeit in a slightly different way than usual this yearNow, you may have found yourself with a few gifts from wellmeaning relatives and inlaws that you appreciate, but just don't loveYes, it's the thought that counts, and getting a gift from someone is always special and heartwarming, but what do you do with

Thank You Notes For Wedding Gifts Messages To Say Thank You For Presents Wishesmessages Com

You Are A Gift To The World You Are A Gift To Me Meaningfulideas S Blog

The gift tax can apply to both cash and noncash gifts If you receive a noncash gift, you may end up paying capital gains tax on a portion of its value even if it falls below the gift taxBetsy Hernandez A Gift to You Lyrics Everything I am Everything I'be I gift it to you Lord And do it thankfully Every song I sing Every praise I bring Everything I do Is a giftIf you're interested in a deeper look at what we offer, we regularly publish new content on our blog, including gift ideas for all kinds of occasions and recipients, home decor inspiration, and more

Hymn A Gift To You Sheet Music Pdf Free Score Download

A Gift To You Kids Worship Song Youtube

A Christmas Gift for You from Phil Spector, , It's Christmas, Of Course, , The Sound of Love The Very Best of Darlene Love A Christmas Gift for You from Phil Spector (originally released as A Christmas Gift for You from Philles Records) is an album of Christmas songs, produced by Jun 27, 11 Celldweller "Gift For YouPlease enter your name, your email and your question regarding the product in the fields below, and we'll answer you in the next 2448 hours If you need immediate assistance regarding this product or any other, please call 1800CHRISTIAN to speak directly with a customer service representativeWhether you're new to the language or are fairly proficient, you can learn what to say when you're giving or receiving a gift in just about any situation Formal and Informal Situations In much of the Englishspeaking world, it is customary to use the right tone when giving and receiving gifts

41 Thank You Note To The Boss For Gift Examples

Electronic Gifts For Teen Boys They Will Go Crazy For These

In 19, you can give up to $15,000 to an unlimited number of individuals each year without paying a gift tax or even reporting the gifts If you give over that amount to any individual, however, you must report the gift on your tax return, but you don't have to pay taxes until you give away more than the current lifetime limit of $114 millionA Christmas Gift for You from Phil Spector, , It's Christmas, Of Course, , The Sound of Love The Very Best of Darlene Love A Christmas Gift for You from Phil Spector (originally released as A Christmas Gift for You from Philles Records) is an album of Christmas songs, produced by Jun 27, 11 Celldweller "Gift For YouA gift to you

Download Everything I Am Lyrics Mp3 Mp4 Free All Kirel Mp3

A Gift To You 1 Kwscm Youtube

The gift you recently gave me accomplished just that!A GiFt To You Lyrics Everything i am , ,, / Everything I'll be,, / I give it to you lord / An do it thankfully , / Thankfully / Chorus every song i sing every praise i bring / Everything i do its aA Christmas Gift for You from Phil Spector (originally released as A Christmas Gift for You from Philles Records) is an album of Christmas songs, produced by Phil Spector, and originally released as Philles 4005 in 1963 Spector treated a series of mostly secular Christmas standards to his "Wall of Sound" treatment, and the selections feature the vocal performances of Spector's regular artists

A Gift For You This Holiday Season Paul Castain

Your Presence Is My Favorite Gift Christian Gospel Song Lyrics And Chords

The person gifting files the gift tax return, if necessary, and pays any tax If someone gives you more than the annual gift tax exclusion amount ($15,000 in ), the giver must file a gift tax return That still doesn't mean they owe gift tax For example, say someone gives you $,000 in one year, and you and the giver are both singleThank you for being so great 85 Thank you for this gift Please always remember how much I cherish you and the things you do for me You are so thoughtful and caring, and I thank you 86 I cannot express to you just how special I felt when I received your marvelous giftWhat would you like to know about this product?

A Gift To You Instrumental Youtube

Our Gifts To You Care My Cars

A Gift To You Chords by Misc Praise Songs Learn to play guitar by chord / tabs using chord diagrams, transpose the key, watch video lessons and much moreA Gift to You 1 kwscm( New version 2 available here https//wwwyoutubecom/watch?v=IaRZQo_2MP8 )The gift you recently gave me accomplished just that!

Free 6 Sample Thank You Note For Gift In Pdf Ms Word

30 Thoughtful Thank You Gift Ideas To Show Your Appreciation Dodo Burd

The individual gave gifts to at least one person (other than his or her spouse) that are more than the annual exclusion amount for the year The annual exclusion amount for and 21 is $15,000 The individual and his or her spouse are splitting all gifts made by each other during the calendar year An individual may make a gift of theThe IRS gift tax is a tax imposed on those who give money or property to others Every year an individual can give up to $15,000 to as many people as he likes without incurring a gift tax You must report gifts valued at over $15,000 made in one year to one individual, including real estate equityIf you're interested in a deeper look at what we offer, we regularly publish new content on our blog, including gift ideas for all kinds of occasions and recipients, home decor inspiration, and more

A Special Gift Of Love Love Letters From The Heart

A Gift To You Minus One Youtube

The greatest gift you can give someone is your time because when you are giving someone your time, You are giving them a portion of your life that you will never get back Anonymous 55 Each day is a gift don't send it back unopened Anonymous 56 God gave us the gift of life;Often, the gifts you find to express your sympathy seem a little too trite for your liking If you're looking for something more earthy and original, this artisan made sympathy gift is a lovelyA Gift To You by Kids Karaoke Lyrics on Smule

Forgiving You Is My Gift To You Moving On Is My Gift To Myself Picture Quotes

5 Priceless Gifts You Deserve To Give Yourself

It is up to us to give ourselves the gift of living wellIt is up to us to give ourselves the gift of living wellYou should give a gift that reflects how long you've known each other and how close you are If you give too expensive of a gift to a new friend, they'll be put off by it By the same note, a generic gift for an old friend may make your friend feel as if you weren't as close as they thought you were

A Gift To You Avi Youtube

Miss Minimalist S Gift Avoidance Guide

You've made a taxable gift of $15,000 if you give your child $15,000 to buy a car and another $15,000 to pay off their credit card debt in the same year—$30,000 total minus the year's $15,000 exclusion You're required to file IRS Form 709 to report the second $15,000 gift, but you have an option to avoid paying the gift tax on that as wellA gift to youThe gift recipient's carryover basis can be increased where the donor has paid a federal gift tax on the transfer The amount of the gift tax that is attributable to the appreciation in value of the asset as of the date of the gift can be added by the recipient to his carryover basis For instance, if the donor's cost basis in an asset is

30 Gift Ideas For Expat Friends Family Overseas Or Moving Abroad Migrating Miss

Our Gift To You In Minecraft Marketplace Minecraft

A Gift to You is an uplifting song sung by kids This video is with lyrics so that children and teachers can use this in church and Sunday school I don't knIf you're shopping for a thank you gift but don't really know the recipient on a personal level, a gift card is a great way to give thanks without worry about what they might likeBut you'd have a capital gain of $250,000 if you inherited the deceased's tax basis and they bought that property for $100,000 decades ago and gave it to you as an outright gift during their lifetime the difference between the $100,000 basis and your sales price

100 Thank You Messages For Gift Wishesmsg

My Gift To You Alexander O Neal Album Wikipedia

Gift applies to a wider range of situations Gifts can be talents You can have the gift of gab, or a musical gift Gifts can be intangibles There is the gift of understanding or the gift of a

Is There A Hidden Meaning To Why He Gave You A Gift

45 Unique Meaningful Or Simply Awesome Gifts Less Than 50

The Best Gifts To Send Someone Other Than Flowers Popsugar Smart Living

Amazon Com Fustmw Inspirational Keychain Gifts To My Son Daughter Graduation Gift We Pray You Ll Always Be Safe Enjoy The Ride And Never Forget Your Way Back Home To My Son Black Jewelry

You Are A Gift From God Quotes Quotesgram

17 Thoughtful Thank You Gifts For Men

A Gift To Bring You Poetry Collection Rumi Love Quotes Rumi Quotes Soul Rumi Poetry

Your Talent Is God S Gift To You Saint Benedict S Monastery

10 Ways To Give The Gift Of Your Presence The Best Gift You Can Give Tiny Buddha

40 Best Teacher Gift Ideas Present Ideas For Teachers 21

Gift Card Envelope Style A A Gift For You Sheppard Envelope

I Love You You Are Such A Precious Gift To Me We Dont Know Where This Is Going But Please Know You Have Changed Romantic Quotes Love Yourself Quotes Quotes

Amazon Com Blue Mountain Arts Miniature Easel Print With Magnet Thank You For Being A Blessing In My Life 4 9 X 3 6 In Sweet Thank You Gift To Express Gratitude To Someone Who

Unconditional Love Poster My Gift To You This Christmas Maggie Dent

You Are God S Best Gift To Me Growth Marriage

What To Do When A Christmas Present Won T Arrive On Time

Amazon Com You Are A Gift To Me Magsamen Sandra Magsamen Sandra Books

A Gift To You Lyrics And Music By Kids Arranged By De Rud

50 Best Gifts For Boyfriends 21 Cool Gift Ideas For Your Bf

How To Graciously Let Others Know You Won T Be Buying Them A Gift This Year Gift Giving Receiving Teach By Example Etiquette School Of America Maralee Mckee

Worshiping An Xtreme God Ppt Video Online Download

Do You Bring A Gift To A Gender Reveal Party Gender Reveal Celebrations

Korn My Gift To You Guitar Tab In C Minor Download Print Sku Mn

A Gift To You Kids Worship Songs Youtube

You Are A Gift Happy Birthday Wishes Card For Niece Birthday Greeting Cards By Davia

Thank You Message For Gift In 21 Weds Kenya

/giving-and-receiving-presents-in-english-1212057_FINAL2-c505030df84e4ebda9bcbb6c8221aab2.png)

How To Give And Receive Gifts In English

How To Ask For Money As A Wedding Gift Money Poems And More

How To Gift A Good Gift Style Guides The New York Times

God S Gift To Me Sweet Love Poem

Writers Quotes Interviews Artist Biography Paris Review Words Of Wisdom Quotes Quotes Poetry Words

You Are The Gift Happy Birthday Wishes Card For Mom Birthday Greeting Cards By Davia

What To Do When Someone Gives You A Gift And You Didn T Get Them One Huffpost Life

Melany Evans A Gift To You Lyrics Musixmatch

Thank You For The Gift Messages Thetalka

My Gift To You 1 Lyrics Alexander O Neal

A Gift To The People You Hate 19 Synopsis Cast

Find The Perfect Gift Every Time 8 Crucial Questions You Need To Ask

A Gift To You Lyrics And Music By Kids Arranged By De Rud

Our Gift To You This Holiday Easier Than Ever Ways To Shop Save And Celebrate At Target

Surprise 5 Great Ways To Present A Special Gift Jewelry Wise

Debbie Ford Quote Live In The Knowledge That You Are A Gift To The World 10 Wallpapers Quotefancy

31 Great Christmas Gift Exchange Ideas Real Simple

A Gift To Youall Versions Sheet Music Piano Score Free Pdf Download Hk Pop Piano Academy

You Are A Gift From God Quotes Quotesgram

15 French Gifts You Can Order Online In Time For The Holidays Frenchly

Gift Of A Friend Guitar Chords Docsity

A Gift To You Lyrics Youtube

What Are The 9 Best Types Of Gifts To Give Your Customers Inc Com

How To Send A Gift In Fortnite Battle Royale

How Psychology Can Help You Choose A Great Gift

/receiving-gifts-love-language-4783665-FINAL-ba71b8b96cbe4ddcad93eed18dec2a62.png)

What The Receiving Gifts Love Language Means For A Relationship

Best Thank You Gifts Thoughtful Gift Ideas To Say Thanks Woman Home

Display Song

Ton Of Thank You Message To Your Girlfriend For The Birthday Gift

Betsy Hernandez Gift To You Sheet Music In E Major Transposable Download Print Sku Mn

Your Love Is A Gift You Are A Gift So This Is Exactly What I Have For You Me And Birthday Wishes For Friend Birthday Wishes Quotes Birthday Wishes Messages

48 Best Thank You For Gift Messages For Manager

28 Best Friend Gift Ideas Unique Gifts To Get Your Bff

Gift Ideas For The People Who Purchased Your Home Sunshine And Rainy Days

3 Tips For Buying A Gift How To Give The Perfect Gifts When You Don T Know What To Buy

A Gift To You 1 Kwscm Youtube

What You Are Is God S Gift To You What You Become Is Your Gift To God Relishquotes

Today Is My Gift To You Photographs Of Ireland Reflections For Today Spiritual Guidance Relaxation Ireland

Hans Urs Von Balthasar Quote What You Are Is God S Gift To You What You Become Is Your Gift To God 12 Wallpapers Quotefancy

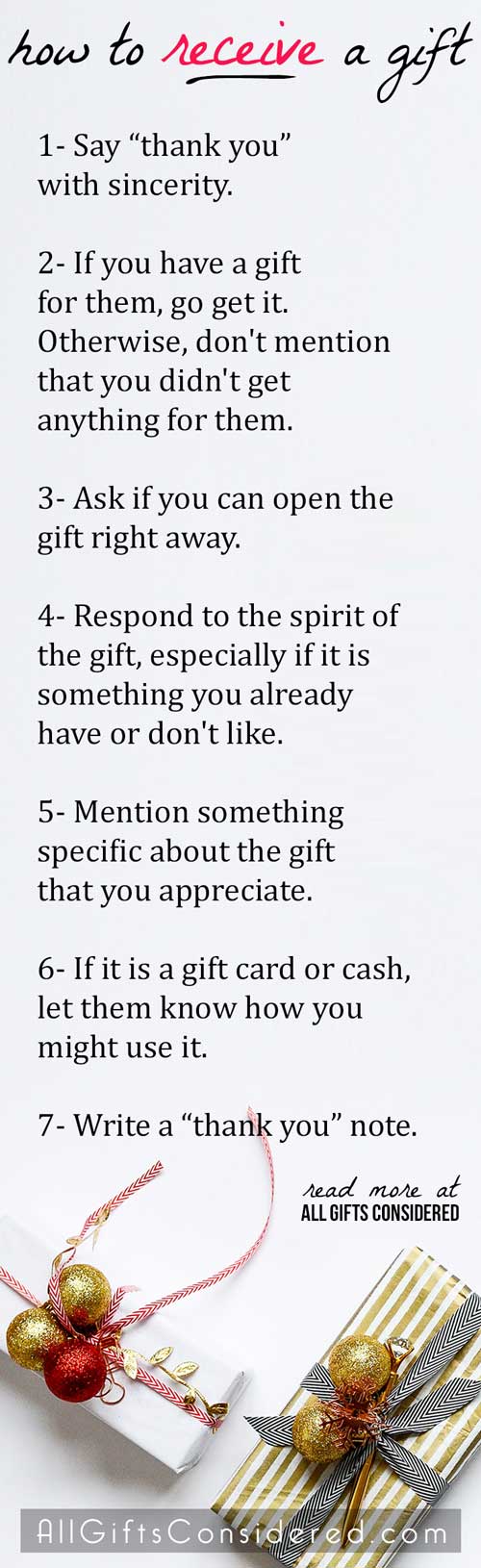

Gift Etiquette How To Receive A Gift The Right Way All Gifts Considered

How To Receive A Gift With Grace Do This Or The Giver Will Feel By Richie Norton Medium

Giving A Gift When You Aren T Invited Southern Bride

Creative Ways To Give A Gift Give Money Trips Or Anything Wagoners Abroad

How To Gift Items In Fortnite Dexerto

A Gift For You Steemit

Pondok Mas Indah A Gift To You

No comments:

Post a Comment